salt tax new york state

The Budget Act includes a provision that allows partnerships and NYS S corporations to elect to pay NYS tax at the entity level in order to mitigate the impact of the 10000 cap on SALT deductions. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018.

Nyc S High Income Tax Habit Empire Center For Public Policy

New Guidance Affected Industries and What to Know Before the October 15 2021 Deadline.

. Scott is a New York attorney with extensive. On April 29 2022 the New York State Department of Taxation and Finance issued two sets of final draft regulations relating to the corporation franchise tax reform that took effect for tax years beginning on or after January 1 2015. If you pay state and local taxes during 2021 in the amount of 15000 then you are allowed to take a federal tax deduction of 10000 on your IRS tax return if you itemize.

Cuomo has been pounding SALT the federal income-tax deduction for state and local taxes. Court upholds New York City tax. The groups New York State tax attorneys are also well-versed in multistate international and cross-border tax matters.

In-Depth Coverage of Issues Surrounding State and Local Tax. Assuming this taxpayer also owns a home in New York property taxes will consume much of the 10000 federal cap so this SALT workaround will allow the taxpayer to deduct up to 10000 of state and local taxes paid in addition to a 12000 charitable contribution instead of being limited to a 10000 deduction for the total state and local taxes paid. The SALT cap limits a persons deduction to 10000 for tax years beginning after.

1 2021 electing entities are taxed at the following marginal rates. While other states are considering workarounds to the Tax Cut and Jobs Acts TCJA 10000 annual limit on the federal deduction for state and local taxes SALT on individual income tax returns New York became the first state to pass actual legislation. 685 for incomes not over 2 million 965 for incomes over 2 million but not over 5 million 103 for incomes over 5 million but not over 25 million and 109 for incomes over 25 million.

New York also will allow. Since its purpose is to provide a SALT limitation workaround to New York State taxpayer individuals the tax is imposed at rates equivalent to the current and recently increased New York State. SALT paid by the.

The limitation on the deductibility of state and local taxes SALT at 10000 was part of the Tax Cuts and Jobs Act back in 2017 and without pointing fingers it seemed to many like it may have been taking a. Avoiding the SALT Limitation New York Enacts a Pass-Through Entity Tax to Help Taxpayers Work Around the SALT Limitation. Effective for tax years beginning on or after Jan.

This provision is not available for publicly traded partnerships. New York Post. The federal Tax Cuts and Jobs Act of 2017 eliminated full deductibility of state and local taxes SALT effectively costing New Yorkers 153 billion.

Base pay range 86000. For the better part of three years now Gov. Since its purpose is to provide a SALT limitation workaround to New York State taxpayer individuals the tax is imposed at rates equivalent to the current and recently increased New York State personal income tax ratesthat is at 685 percent of pass-through entity taxable income of up to two million dollars with excess income taxed at rates of between 965 percent.

July 1 2021 By WFFA. The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes. This range is not provided by CohnReznick LLP it is based on 4 Linkedin member-reported salaries for Tax Manager at CohnReznick LLP in New York New York United States.

After President Trump signed the GOP-sponsored tax-reform bill in December 2017 Cuomo called the new laws 10000 SALT deduction cap an all-out direct attack on New Yorks future and. In-Depth Coverage of Issues Surrounding State and Local Tax. Our firms State Local Tax SALT Practice offers exceptional experience in all New York State New York City and multistate tax issues to our clients.

If you paid 5000 in state taxes then you can deduct the full 5000 of state taxes paid on your federal return as an itemized deduction. New York led a group including Connecticut New Jersey and Maryland in trying to strike down the 2017 limit known as the SALT cap which limits people to 10000 of their state and local property. New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021.

Whats worse is that the law disproportionately hurts Democratic states like New York which already contributes 356 billion more annually to the federal government than it gets back. Posted in New York. The Supreme Court on Monday declined to review a challenge to the 10000 ceiling imposed on the state and local tax SALT deduction one of the most controversial provisions of the 2017 tax bill.

By Eversheds Sutherland SALT on May 4 2022. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states like New York New.

New York has issued long-awaited guidance and clarifications on the Pass-Through Entity Tax PTET via a Taxpayer Services Bulletin issued on August 25 2021 TSB-M-21 1C 1I. 11 rows Residents of New York take the highest average deduction for state and local taxes according. How New York State Responded to The SALT Deduction Limit.

New Yorks SALT Workaround. The Pass-Through Entity tax allows an eligible entity to pay New York State tax. The New York State NYS 20212022 Budget Act was signed into law on April 19 2021.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

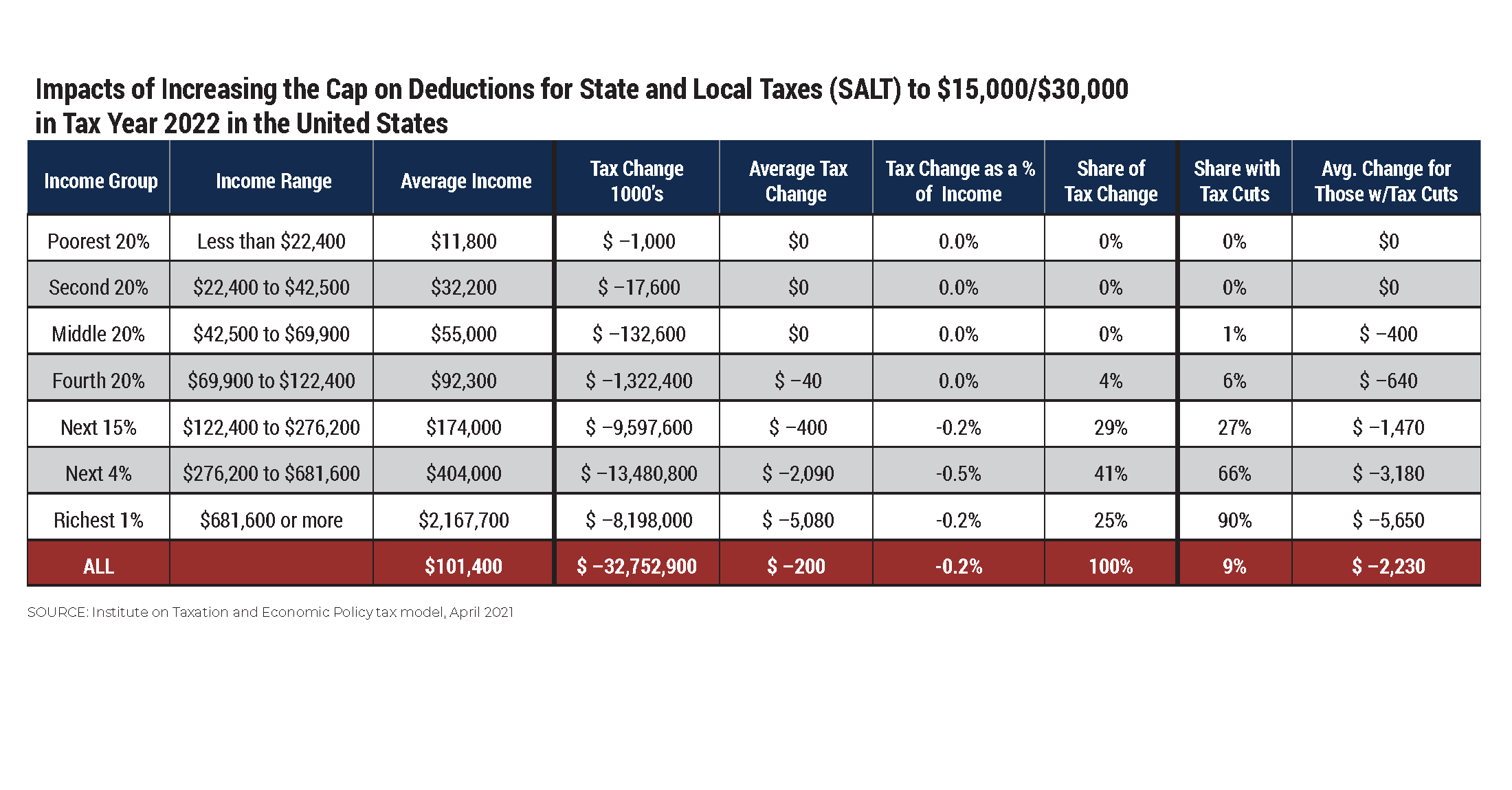

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

The Buried Boon To The Wealthy In The Democrats Tax Plan The Economist

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Salt Tax Increase That Burned Blue States Is Targeted By Democrats The New York Times

This Bill Could Give You A 60 000 Tax Deduction

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Don T Miss The Election For The Salt Cap Workaround

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget